State Bank VCC or Electronic Cards or Often Known as E-Card is One Of The Safest Mode of Payment Among Different Merchants In India. As Online Crime Like Phishing and Hacks Have Increased That’s Why Using Sbi Virtual Credits Cards Are Much Safer As Compared To Regular Credit Cards.You can used sbi vcc as a normal debit or credit card. Once you have used your card it will be blocked automatically by system and Even if you don’t use it for two days, it will again get blocked by itself. That’s why we are taking it as a most flexible and safest mode of payment. Virtual cards can also be created with ICICI Bank, Axis Bank and also on HDFC Banks but State bank gives more flexibility as compared to any other bank.how to create free online SBI virtual credit cards, just follow the simple steps below:-

Features of SBI Virtual Cards:-

Can Be Created As Many Times As Per Need.

No Extra Tax or Transaction Fee For Card Creation or Usage.

Reliable and More Secure Than Physical Credit or Debit Cards.

Build for Single Time Usage ( Will Be Automatically Blocked After First Transaction )

Requirements For Sbi Virtual Credit Cards:-

You must have State Bank Account Obviously

You Must Have Internet Banking Enable On That Account

Your Mobile Number and PAN Card Must Be Linked With Your Account.

How To Create SBI Virtual Credit Cards:-

Go to OnlineSBI From This Link

Go To Personal Banking and Log In With Your Credentials ( User/Pass )

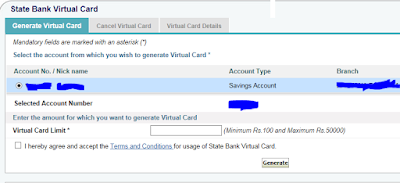

Now After Successful Login Go To E-Cards Section ( As Shown In Image Below )

Enter Any Desired Amount, You Want To Be In Your Virtual Card ( Between Rs.100 to Rs.50000) and Tick “Terms and Conditions” and Click on Generate Button.

Now an OTP ( One Time Password ) Will Be Sent To Your Mobile Number Which You Have To Put On Your Screen.

Done, Next Screen You Will See Your Virtual Credit Card.

Note Down the Details of the Cards Like Name, 16 Digit Card Number, CVV, Expiration Date.

How to use SBI Virtual Card:-

Select required goods / services on merchant website.

Select State Bank Debit Card / Visa Card from the payment options.

Enter the Virtual Card details on the website.

Enter your secure 8-Digit password (OTP), received on your mobile.

After successful validation, you will receive SMS on your registered mobile confirming the transaction.

After the transaction, the Card will be de-activated and cannot be used again.

How Transaction Works On SBI Virtual Credit Card:-

If You Have Rs.5000 in Your Virtual Card and You Made a Transaction of Rs.4600 Then Rest of the Amount Will Be Credited in Your SBI Account Automatically.

If You Dont Used Your Card For More Than 2 Days Then It Will Be Automatically Blocked For Security Reason. But You Can Create New VCC At Any Time You Want.

This comment has been removed by the author.

ReplyDelete